Who We Are

Inpulse is a Brussels-based investment manager with special know-how on social investments and microfinance. From a core expertise in cooperative equity financing, we developed strong skills in managing alternative investment funds providing responsible long-term financing to socially driven financial intermediaries. Strong connections with leading microfinance and social economy networks and multiple partnerships with successful stakeholders ensure a sound understanding of the market we invest in. Through our team based in three countries (Belgium, Poland and France), we currently support three active MIVs with a total aggregate investment capacity of EUR 53M. The social and financial performances of the funds under management prove the success of our methodology to identify, appraise and monitor our investments..

Inpulse strives to bring positive changes in the life of final beneficiaries while ensuring competitive financial and social returns for both our clients and investors. This is Inpulse ADN.

Our Ambition

Inpulse wants to be a leader in providing long-term responsible finance to empower vulnerable groups. Impulse aims to foster cooperative values, boost local economies and encourage social inclusion through entrepreneurship.

Our Mission

Inpulse commits to:

- tailor and engineer fair financial and non-financial services to serve inclusive financial institutions;

- manage and advise investment vehicles sharing the same ambition;

- leverage resources addressed to responsible economic initiatives;

- operate as an impact driven organisation joining professional investors and ultimate beneficiaries.

Our Values

In order to reach out to our ambition, Inpulse team is committed with the company on shared values and ethics.

Integrity

Our actions are driven by honesty, fairness and high moral principles.

Transparency

Our decisions are guided by principles of transparency and good faith.

Respect and fairness of treatment

We treats all individuals with respect and dignity regardless of their differences.

Exemplarity

We act of a such high quality to serve as an example to each other, to our clients and investors.

The Board of Directors is composed of:

- Pierre VALENTIN, Chairman of the Board

- Anne-Sophie BOUGOUIN, Board Member

- Antonia LAMBERT-ALCANTARA, Board Member

- Michel Chatain, Board Member

- Patrick Saurat, Board Member

- Pascal POUYET as representative of Crédit Coopératif, Board Member

- Dany MAKLOUF, Board Member

- Birgitta VAN ITTERBEEK, Board Member

- Dominique de CRAYENCOUR, Board Member

- Inpulse is a cooperative limited company registered under Belgian Law.

- Inpulse majority shareholder is SIDI, a French impact investor, which owns 65%.

- Groupe Crédit Coopératif is the other main shareholder.

The core objective of Inpulse is promoting sustainable investments throughout our fund management duties applying an ESG approach which integrates social, environmental and governance dimensions. Integration and contribution to UN Sustainable Development Goals are at the heart of Inpulse mission. Our goal is to provide investors with strategies to reconcile the search for financial return with a positive impact on society and the environment where the funds we manage are invested in.

Inpulse commitment for “Social and Financial Inclusion” addresses projects and institutions with a strong social and environmental impact in their region and country, in particular for the benefit of the most vulnerable populations. The investment strategies for “Energy Transition Infrastructures” will be exclusively focused on solutions promoting the energy transition, i.e. the production of clean energy, green mobility, improvement of energy performance, etc.

The concept of impact is applied all across our investment process, from ex-ante integration of sustainable development objectives within the investment criteria of all our funds, and ex-post reporting on environmental and social impact. We make sure that the investees of all our funds are institutions that are not only financially sustainable, but also that seek to alleviate socio-economic problems, while avoiding to harm their final clients.

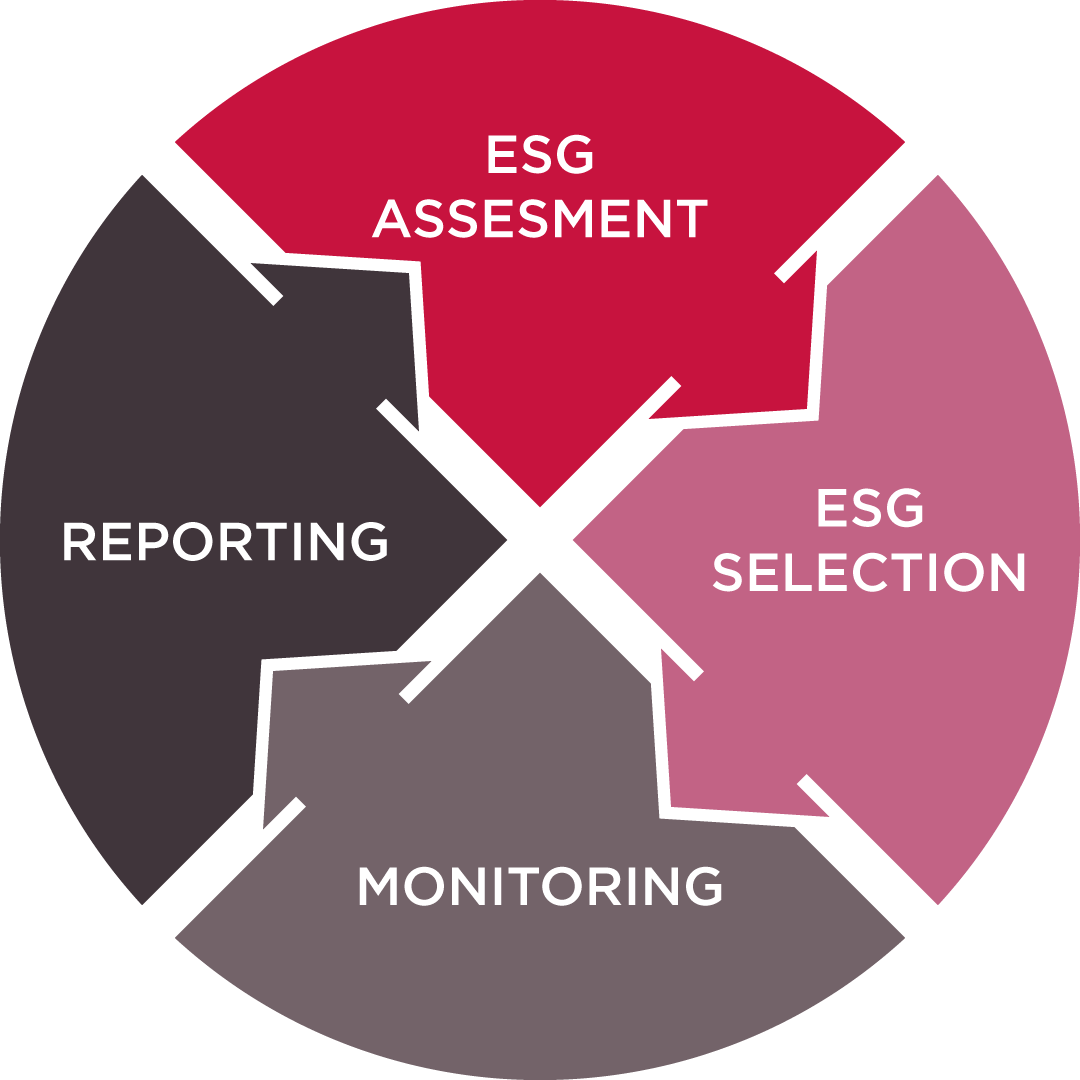

The methodology we use is aligned with the best practices of the sector, namely the Universal Standards of the Social Performance Task Force (SPTF), the IRIS guidelines by the Global Investing Network (GIIN), the European Code of Good Conduct for Microcredit Provision, the SPI4 Green Index and the 2XChallenge initiative. The impact approach has been elaborated in our Sustainability & ESG Policy and translated into practice through our ESG Management System to assess, select, monitor and report on all our investments.

- Assessment: to exclude institutions engaged in activities, practices or countries with high ESG risks (negative screening) we verify that the potential investee doesn’t breach our exclusion list as well as local and international policies.

- Selection: during due diligences, all potential investees are required to complete a Social Scorecard which evaluates the most relevant ESG indicators to score its non-financial performance/ESG sustainability. Based on this positive screening, our decision-makers can approve investments and set up impact objectives (reflected as social “soft” covenants in the legal documents).

- Monitoring: to track performance, progress and compliance all along the investment period our investees are required to complete on yearly basis an ESG Smartsheet. This is based on relevant, quantitative and qualitative indicators, focused on gender, environment, social outreach, governance and SDGs analysis. Thanks to this information we are also able to identify main weaknesses and put in place tailored technical assistance when available.

- Reporting: Impact Reports are published annually by Inpulse to disclose the non-financial results of the funds under management. In line with SFDR Directive we provide transparent and enhanced information in terms of environmental and social responsibility of our financial products, in particular through the provision quantitative data on non-financial sustainability of our investments.

ALIGNMENT WITH SUSTAINABLE FINANCE DISCLOSURE REGULATION (EU SFDR)

The European Commission boost for sustainable finance is changing fast the traditional views of finance and a new awareness is growing about environmental, social and governance issues. The Sustainable Finance Disclosure Regulation (SFDR) EU Regulation came into effect in March 2021 to create a framework of harmonized rules within the EU on disclosing information about sustainability characteristics of different financial products.

Being a long-standing impact investor Inpulse is fully committed to responding to these new challenges and obligations with regard to sustainable finance. Our investment approach takes seriously into account the sustainability risks underlying our investments and integrate non-financial criteria into funds’ investment management.

All the funds assisted by Inpulse are based on impact management process, significantly incorporating non-financial criteria. These financial products pursue sustainable investment objectives, and, through them, our aim is to maximize the positive environmental and social impact of each of our investments. These funds are labelled as “impact investment” products and comply with SFDR art.9.

Alignment with art. 3,5 SFDR > Sustainability & ESG Policy

Alignment with art. 4 SFDR > Annex I, Principal adverse sustainability impacts statement