In the current challenging times of COVID-19, the impact on our day-to-day life (globally but especially in Europe and MENA) is already tangible. Uncertainty about the length of the crisis is currently high and first questions arise about the way and the time of getting out of this unprecedent crisis.

Over the past weeks, Inpulse has carried out an investigation to assess the preliminary impact of the COVID-19 crisis on our partners. By doing this, we aimed to get a better understanding of our clients current challenges to assess what strategies and solutions we could propose to them in line with their needs. Besides, we wanted to better inform our stakeholders about the evolution of this exceptional situation on our funds and our operations.

The research was based on surveys of 27 client partners, located in 15 countries in Europe and the MENA region. We were very pleased of the high response rate of 89%[1].

1. Government measures

The authorities of all the countries where our partners are located have adopted different measures to reduce the contagion by COVID-19. However, while in some countries, establishment and border closures, as well as mandatory quarantine and a state of emergency have been established immediately (as is the case in Palestine, Bulgaria, Romania and Bosnia and Herzegovina). In other countries (as is the case in Kosovo and Moldova) partial containment only are in place which allows MFIs to maintain part of their operations, although with certain restrictions due to the lack of infrastructure to handle cash in their offices (service provided by banking institutions).

More than 80% of our partners are positive about the measures that the government or financial authorities are preparing to alleviate the impact of economic slowdown. However, there is still uncertainty due to the fact that many of these measures have been announced recently, but their execution has not been officially concluded.

Approximately 60% of our partners indicated that the authorities of their country have established official measures to help their clients or members against the economic impacts generated by the coronavirus pandemic. These measures mainly include providing temporary unemployment benefits for employees (e.g. Albania, Poland, Romania, Morocco) and calls for refinancing and rescheduling of loans, no charging penalties for any borrowers that is late during this period of time (e.g. Palestine or Albania).

In general, the institutions surveyed in the MENA region reported that discussions are ongoing with the government and financial authorities to get specific guidelines and support in order for the sector to help their clients as well as to reduce the economic impact on their businesses.

2. Current operations

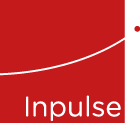

In accordance with the directives of the government of each country, our partners have taken different measures to protect their staff. Most of these are concentrated in quarantine and social distancing. Specifically, as can be seen in the following graph, 86% of them have established work from home, 29% have introduced staff turnover to reduce the number of employees in the offices and 14% have limited the number of clients in their offices. All our partners have succeeded to implement their business plan continuity without major breakdown and in very short time notices.

On the other hand, 100% of the surveyed institutions anticipated a slowdown in their credit activities. Some of them considered that activities may restart already in April, while others estimated that the slowdown would last at least until June.

Our partners pointed out that the lockdown represents a high impact on activities related especially to tourism and that due to the uncertainty of when the crisis would end,

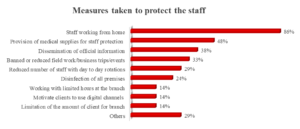

there will be a reduction in the demand for credits. However, some of them also indicated that there are (or remain) financing opportunities from other sectors such as agriculture (plant cultivation and animal production), freight transportation, trade with food and pharmacies. Consequently, 29% of our partners considered that liquidity needs will increase (some of our partners anticipated liquidity needs due to drop in repayments of loans) and 38% still have uncertainty about the way in which their liquidity will be affected, since for them this will depend on the length of the lockdown period.

3. Risk management / credit risk

At the time of answering the survey, 95% of our partners have started to assess potential impact on their institution. The balance of this preliminary analysis shows the following results:

- Health of staff and families: The current impact on the health of their employees is, as of the date of providing feedback to us, very low, none of them or their family members are infected by COVID-19. Employees are informed, health protection measures are taken and they are implementing the authorities recommendations besides to additional actions to prevent the possible exposures to the virus.

- Health of clients/members: The current impact on the health of their clients has been reported low, none of them have reported being infected, but it is perceived that their potential risk of contracting the virus is very high. Faced with this scenario, some institutions show uncertainty and difficulty in doing something about it, others, on the contrary, try to know the state of health of their clients (to the extent that they can), performing follow-up and monitoring through different technological means.

- Business activities of clients and their reimbursement capacity: 95% of the surveyed institutions indicated that the impact on the economic activities of their clients is significant. Some of their clients temporarily shut down activities, others experienced reduced turnover. Nevertheless, our partners have observed that some clients started to adjust the operations of their businesses, others started a new activity, and others remain open to provide people with daily basic needs. Regarding the potential opportunities, some surveyed partners considered that the agriculture sector will likely be the least affected but pointed out that some of their trade channels need to be changed. Furthermore government subsidies could contribute greatly to mitigating the economic impact of their clients.

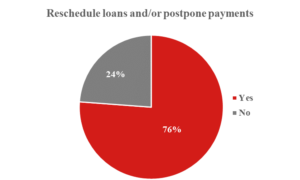

The surveyed partners considered that the repayment capacity will also be significantly affected. 76% of our partners have received some requests from borrowers to reschedule their loans and / or postpone payments.

The surveyed partners considered that the repayment capacity will also be significantly affected. 76% of our partners have received some requests from borrowers to reschedule their loans and / or postpone payments.

Approximately 76% of the surveyed institutions anticipate a deterioration of the portfolio at risk. Some of these indicated that the degradation could be between 40% and 60%. Others, on the contrary, were more optimistic and expected only a 10% worsening. The wide range of estimates may be, as other institutions pointed out, that it is still too early to determine the dimension of the possible deterioration of portfolio. For others surveyed, the level of portfolio at risk is directly related to the effectiveness of the measures implemented by the government to support the economy.

Inpulse will continue to monitor these evaluations to determine the impact on our partners’ portfolios. In the next analysis we hope to provide more accurate data in this regard.

4. Looking forward… specific measures needed!

As concerns revolving credits or short-term loans from local Banks, 57% of our partners do not use them and 43% who do have this source of funds have not received any indication that they may not be renewed / extended. For this reason, our partners are generally positive about the banks’ interest in providing additional financing.

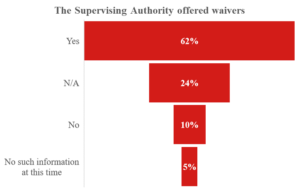

Faced with the potential increase in payment deferrals and credit restructuring, 62% of surveyed institutions stated that their Supervising Authorities are ready to offer waivers on regulatory limits. In general, our partners estimated such ratios and constraints to be relaxed for at least 3 months before showing effect. 24% of institutions are not subject to regulatory limits.

Likewise, to mitigate the credit risks caused by the Coronavirus pandemic, our surveyed partners are implementing one or more of the following measures:

- Continuous contact with customers: Our partners seek to maintain direct and continuous contact with their customers to assess their needs and the problems facing their business due to the pandemic.

- Internal risk assessment: Our partners, through a specific committee put in place or their existing risk committees, are analyzing different future scenarios. The main factors evaluated are liquidity management, main sectors impacted, following cash flow on daily basis, supervision of reimbursement and disbursements levels, among others.

- Targeting of sectors: The loans are being focused on the agriculture and livestock sectors or others that are less impacted.

- Activity targeting: Activities focus on collecting loan repayments, credit restructuring. Some partners are giving up to 3 months grace period for clients whose businesses are negatively impacted.

- Contact, monitoring and analysis of measures taken by the microfinance and banking authorities.

Final remarks

MSMEs have historically been quite resilient to shocks (as the 13-year track-record of our CoopEst fund demonstrates). Nevertheless, this crisis is the first of its kind and the real impacts are difficult to evaluate at this stage. As an impact investor, Inpulse believes that it is during crisis time that responsible investors need to provide adequate support to micro, small and social entrepreneurs.

Faced with these growing challenges from our partners, Inpulse is committed to elaborate on the most adequate support, in collaboration also with the lenders community, to each of our partners to help them and their clients pass through the current crisis.

This is how we believe we can foster local economies, build more social inclusion and create more impact finally.

For some partners, our weekly calls and close monitoring is meant to support management in their tackle of the crisis, sharing on experience and toolkits developed by colleague lenders. With others, the most solid and well-known to our team, we are discussing about short term liquidity lines, depending on available funds.

Inpulse also assess to what extend our existing Technical Assistance facility may contribute to very specific COVID-19 support (implementation on contingency plans, adaptation of lending procedures, support to digitalization shift, etc.).

Inpulse has also joined a coordination group of lenders in order to streamline process, harmonize additional reporting requirements and approach to immediate decisions regarding loan extensions.

For Inpulse, the positive social impact that we can generate in these moments of crisis on the people who have a higher level of vulnerability (the poor, the women and families who face the daily reality of this pandemic) is very important.

Relevant information on the subject

CGAP. COVID-19: How Does Microfinance Weather the Coming Storm? https://www.cgap.org/blog/covid-19-how-does-microfinance-weather-coming-storm

Financial Access Initiative. Resources for MFIs and Investors: What We’ve Learned from Past Shocks and Crises https://www.financialaccess.org/blog/2020/3/24/resources-for-mfis-and-investors-what-weve-learned-from-past-shocks-and-crises

IFC. Helping Companies, Workers During the COVID-19 Pandemic https://www.ifc.org/wps/wcm/connect/news_ext_content/ifc_external_corporate_site/news+and+events/news/covid-19-response?CID=IFC_LI_IFC_EN_EXT

International Monetary Fund. Fiscal, Monetary and macro-financial, Exchange rate and Balance of payments https://www.imf.org/en/Topics/imf-and-covid19/Policy-Responses-to-COVID-19#R

Microfinance Centre. Webinars: How an MFI can act best during the time of the pandemic? Learn from the others’ practices & share yours! http://mfc.org.pl/26-march-2020-webinar-how-an-mfi-can-act-best-during-the-time-of-the-pandemic-learn-from-the-best-mfis-practices-share-yours/

World Bank Group Increases COVID-19 Response to $14 Billion To Help Sustain Economies, Protect Jobs. https://www.worldbank.org/en/news/press-release/2020/03/17/world-bank-group-increases-covid-19-response-to-14-billion-to-help-sustain-economies-protect-jobs

[1] Please note, that as we used open-ended questions, the presented percentage results may not be fully representative. Some differences may also result from the specific dates when the clients prepared the response and what measures were announced by their respective governments as of that date.