Inpulse is a Brussels-based investment manager with special know-how on social investments and microfinance. From a core expertise in cooperative equity financing, we developed strong skills in supporting alternative investment funds providing responsible long-term financing to socially driven financial intermediaries. Strong connections with leading microfinance and social economy networks and multiple partnerships with successful stakeholders ensure a sound understanding of the market we invest in. Through our team based in three countries (Belgium, Poland and France), we currently support four active MIVs with a total aggregate investment capacity of EUR 81M.

Inpulse strives to bring positive changes in the life of final beneficiaries while ensuring competitive financial and social returns for both our clients and investors. This is Inpulse ADN.

Our funds show strong performance in micro and SME finance and generate competitive financial returns. They also have effective social impact in emerging markets by encouraging entrepreneurial spirit. We ensure compliance with international business standards for our Funds, generating high quality financial information. Our company’s core principles focus on integrity, transparency and professionalism. This is the basis of long-standing relationships with all our stakeholders.

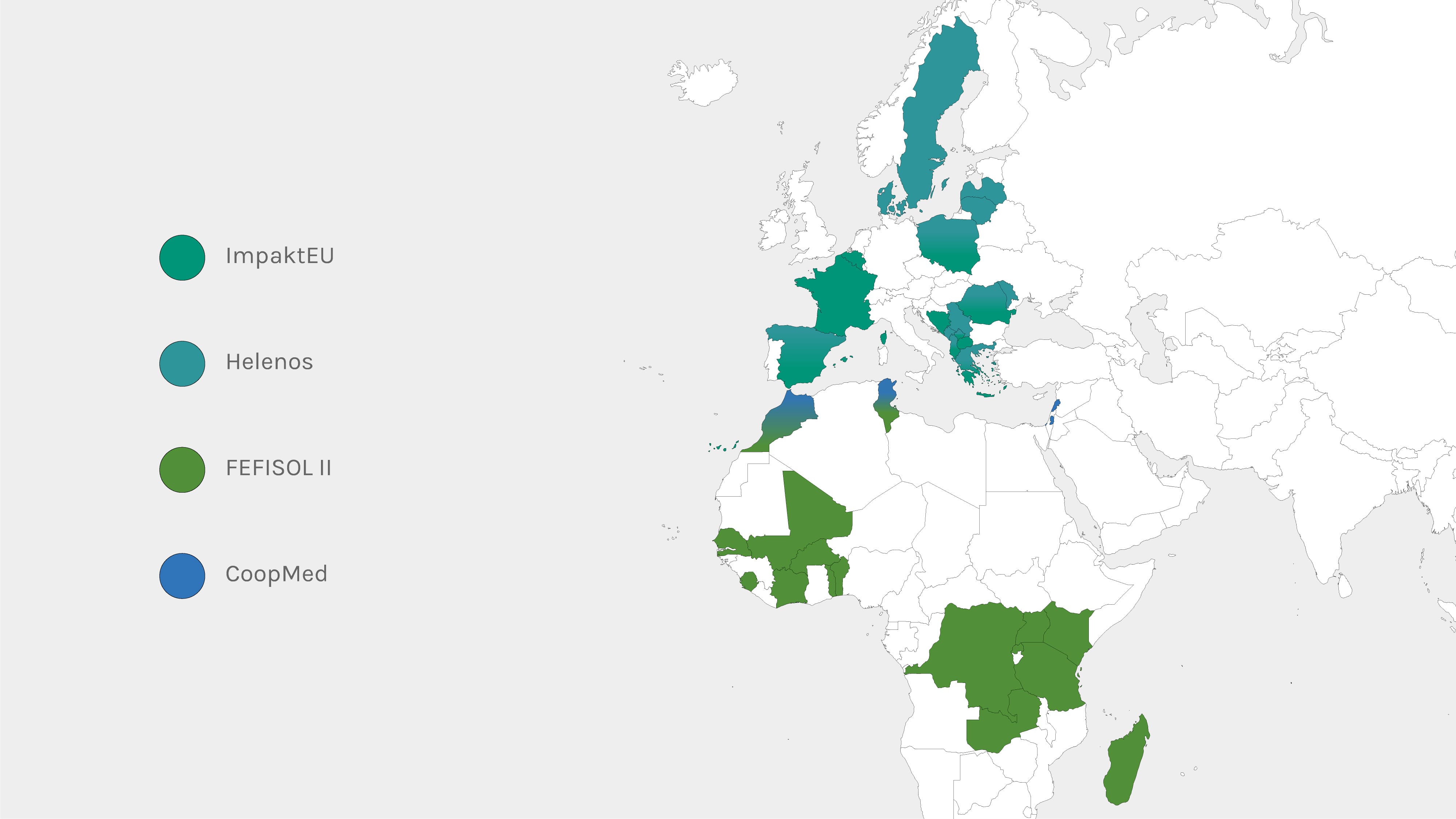

ImpaktEU is an impact first investment fund dedicated to finance entrepreneurship via microfinance and social businesses in Europe and accessing countries. Our objective is to steer the investments towards players whose mission consists in resolving social, economic, and environmental challenges that we are facing. The Fund has a sound Theory Of Change (TOC) and the achievement of impact objectives trigger the variable remuneration of the Fund AIFM, Inpulse and the Fund Advisor, Fund for Good. With a total objective of 100M EUR the Fund has been launched in Q4 2022.

Launched in 2018, Helenos is the first private equity fund for inclusive finance in Europe. It is made to strengthen the capital base of financial intermediaries targeting micro, small and social enterprises. Helenos provides equity, subordinated and senior loans to support economically sustainable and socially oriented institutions. Helenos beneficiates of the support of the European Commission’s Programme for Employment and Social Innovation (EaSI).

The new European solidarity financing fund for Africa, FEFISOL II, closed in May 2022 with EUR 22.5M and a technical support envelope of EUR 1M. FEFISOL II is the successor fund of FEFISOL I, which terminated in July 2021. Promoters for both funds are SIDI (France) and Alterfin (Belgium). Similar to FEFISOL I, FEFISOL II is dedicated to financing with debt instruments African rural microfinance institutions and agricultural entities sourcing from small-holder farmers in Africa.

Built on the succesful track-record of CoopEst, CoopMed develops social finance in the MENA region. The Fund supports the creation of employment and sustainable economic activities by the civil society, and promotes green and innovative initiatives enhancing social entrepreneurship. CoopMed offers subordinated and senior loans to MFIs, local banks and mutual companies. CoopMed applies a strong social performance policy with the support of a dedicated technical assistance facility.

Closed in 05/2024.

CoopEst’s goal was to support responsible financial intermediaries to grow, innovate and improve services while balancing financial performance with positive social impact. CoopEst offered subordinated and senior loans to MFIs, cooperative banks and credit unions operating in countries from Central and Eastern Europe. CoopEst was pioneer in client protection principles, fair competition and social performance while encouraging its clients to comply with best industry standards. More about the Fund achievements and impact generated can be found on :

Through its funds, Inpulse supports a range of institutions covering MFIs and credit unions up to medium size banks with total assets between EUR 1.5 M and EUR 3 billion.

As of December 2021, Inpulse has granted loans to 40 partner institutions in 18 countries for a total outstanding amount of EUR 40.6M. More than the half of the outstanding portfolio is dedicated to support small and medium-size MFIs that are strongly involved in the local development of disadvantaged areas. Our MFI partners serve vulnerable groups excluded from financial services: the average loan size to final beneficiaries is around EUR 4,801.

Our funding partners are international development financial institutions, social and ethical banks, mutual insurance companies and responsible investment companies. Inpulse is in charge of supporting investment funds sharing the same ambitions of boosting local economies and social inclusion trough fostering entrepreneurship. CoopEst was the first financial instrument to combine primary European social economy investors and ethical banks with DFIs. IFC (World Bank Group) subscriptions allowed CoopEst to launch its operations in 2006 and was followed by EIF (EIB Group) which became the second largest shareholder. CoopMed, created by and for the actors of the social economy in the Mediterranean area, benefits from the expertise of its investors who are strongly committed to its objectives. Helenos and ImpaktEU enlarged our partnership to Familly Offices and Hign Networth Individuals. FEFISOL II is a unique combination of European DFIs and institutional investors dedicated to sustainable agriculture and smallholder farming.

Inpulse has a dedicated team of multilingual and multi-skilled professionals committed to bringing positive changes in the life of financially excluded people through adequate support. We are based in three countries (Belgium, Poland et France): 10 staff in Brussels, 4 staff members in Warsaw and 1 in Paris. The team managers and investment team have extensive experience in due diligence, risk management and portfolio monitoring of investees in the social economy, microfinance and the informal sectors. The geographical scope of our staff experience covers the entirety of the European Union, neighboring countries, Africa and Latin America.

Bruno Dunkel

Michal Radziwill

Nicolas Blondeau

Izabela Norek

Justine Palermo

Monika Czerwinska

Laurence May

Francesco Grieco

Valérie Valente

Karina Navarro

Imad Haidar

Zahra KHIMDJEE

Matteo Ragno

Baptiste Rolin

Inpulse Investment Manager SC

88 Rue Gachard

1150 Brussels, Belgium

Inpulse & FEFISOL II

bruno.dunkel@inpulse.coop

ImpaktEU

justine.palermo@inpulse.coop

Helenos

nicolas.blondeau@inpulse.coop

CoopMed

zahra.khimdjee@inpulse.coop

CoopEst

michal.radziwill@inpulse.coop